Implications of the Transportation & Climate Initiative for Vermont

By Mei Butler, EAN Data Manager

November 2021

EAN is pleased to share this Research Brief, “Examining the Implications of the Transportation & Climate Initiative for Vermont.” This release corresponds with the newly-formed Network Action Team, Benefits of the Transportation & Climate Initiative for Vermont. Its purpose is to examine the benefits and costs of Vermont joining the Transportation & Climate Initiative on Vermont households.

Abstract

The Transportation & Climate Initiative Program (TCI-P) is a cap-and-invest program designed to reduce pollution from on-road gasoline and diesel fuels, while generating a new source of funding for clean and equitable transportation investments. The intent of TCI-P is to improve the overall transportation system while reducing overall transportation costs. Potential benefits include building out electric vehicle charging infrastructure, implementing income-based incentives for cleaner vehicles, and making investments in clean and convenient transit options.

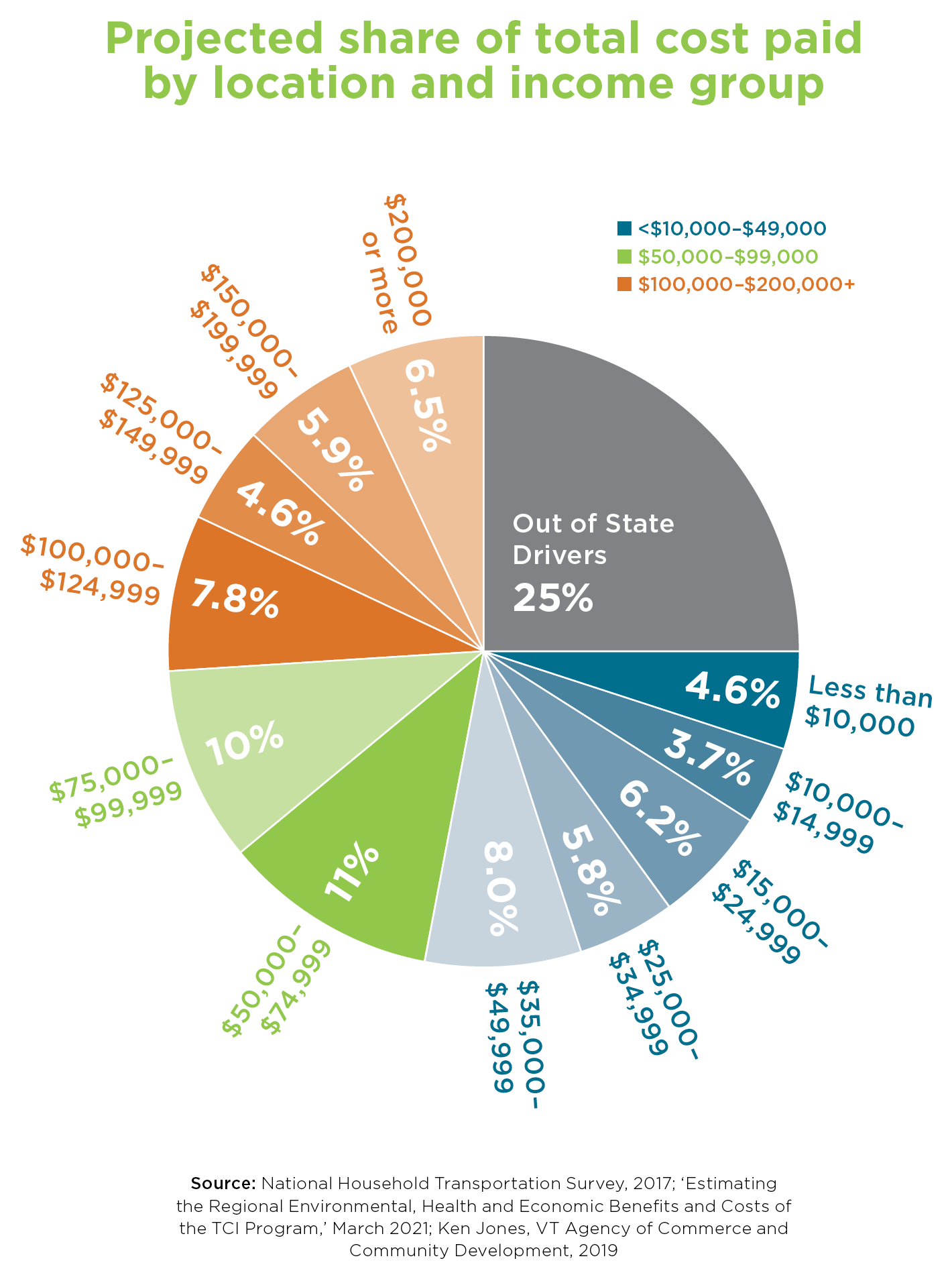

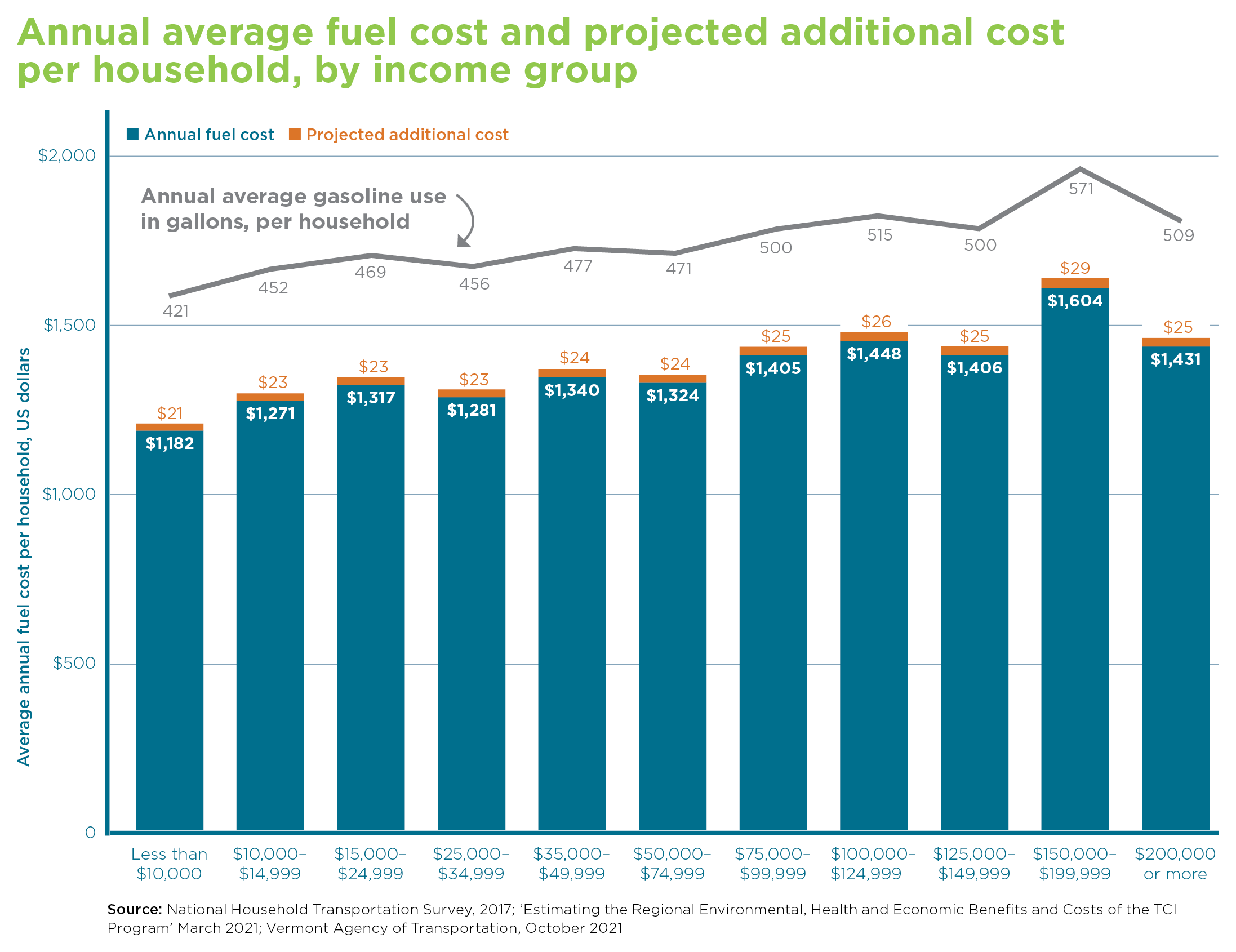

While there are many potential benefits to consumers, there are also potential costs as a result of TCI-P. TCI-P revenue would be collected from fossil fuel suppliers who would be obligated to purchase allowances for their pollution coming from their fossil fuel sales. However, the extent to which TCI-P compliance costs may be passed to consumers is currently unknown. A key question related to Vermont’s participation in TCI-P that this research brief will try to address is: what are the potential cost implications for Vermont gasoline and diesel consumers as a result of the program? Data shows that in the first year of program implementation, TCI-P would result in an average additional cost per household ranging from $21 to $29. On average, households spend $1200 – $1600 per year on transportation fuel, so the projected additional cost from TCI-P would be marginal compared to total fuel costs. Additionally, 50% of the potential total additional cost of TCI-P would likely be borne by out-of-state consumers and households making $100,000 or more per year.

The Research Brief is available to view and download below.